If you have been studying the business pages of major newspapers and business magazines, you will realize that a fierce battle is being waged by believers in demand or supply side economics. Everyone after the Great Depression used to be a demand sider; then Milton Friedman and his conspirators convinced many politians that government spending created short terms fixes but long-term growth problems. I would like to have someone spell out for me what evidence made the majority of economists swing the the demand side camp only in the 1970s and 1980s. David Brooks paints a thoughtful portrait, sympathiszing with demand siders, of the difficult positions Barak Obama and David Cameron are in. With regard to Cameron’s proposal to cut government spending by 40%, I think this is simply a negotiation ploy with the British bureaucracy. If not, God save the British people from the economic pain that Cameron will inflict on them in the short term.

If you have been studying the business pages of major newspapers and business magazines, you will realize that a fierce battle is being waged by believers in demand or supply side economics. Everyone after the Great Depression used to be a demand sider; then Milton Friedman and his conspirators convinced many politians that government spending created short terms fixes but long-term growth problems. I would like to have someone spell out for me what evidence made the majority of economists swing the the demand side camp only in the 1970s and 1980s. David Brooks paints a thoughtful portrait, sympathiszing with demand siders, of the difficult positions Barak Obama and David Cameron are in. With regard to Cameron’s proposal to cut government spending by 40%, I think this is simply a negotiation ploy with the British bureaucracy. If not, God save the British people from the economic pain that Cameron will inflict on them in the short term.

A Little Economic Realism

By DAVID BROOKS (NY Times)

Let’s say you’re the leader of the free world. The economy is stuck in the doldrums. Naturally, you want to do something.

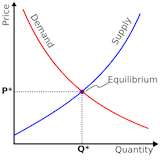

Many economists say we need another stimulus bill. They debate about whether the stimulus should take the form of tax cuts or spending increases, but the ones in your party are committed to spending increases. They trot out a plausible theory with computer models to go with it. If the federal government borrows X amount of dollars and pumps it into the economy, that would produce Y amount of growth and Z amount of jobs. In a $14 trillion economy, you’d probably have to borrow hundreds of billions more to have any noticeable effect, but at least you’d be doing something to help the jobless.

These Demand Side theorists are giving you a plan of action. But you’re not a theorist. You’re a practical executive, and you have some concerns.

These Demand Siders have very high I.Q.‘s, but they seem to be strangers to doubt and modesty. They have total faith in their models. But all schools of economic thought have taken their lumps over the past few years. Are you really willing to risk national insolvency on the basis of a model?

Moreover, the Demand Siders write as if everybody who disagrees with them is immoral or a moron. But, in fact, many prize-festooned economists do not support another stimulus. Most European leaders and central bankers think it’s time to begin reducing debt, not increasing it—as do many economists at the international economic institutions. Are you sure your theorists are right and theirs are wrong?

The Demand Siders don’t have a good explanation for the past two years. There is no way to know for sure how well the last stimulus worked because we don’t know what would have happened without it. But it is certainly true that the fiscal spigots have been wide open. The U.S. and most other countries have run up huge, historic deficits. And while this has helped save public-sector jobs, we certainly haven’t seen much private-sector job growth. It could be that government spending is a weak lever to counter economic cycles. Maybe monetary policy is the only strong tool we have.

The theorists have high I.Q.‘s but don’t seem to know much psychology. Lord Keynes, though a lesser mathematician, wrote that the state of confidence “is a matter to which practical men pay the closest and most anxious attention.”

These days, debt-fueled government spending doesn’t increase confidence. It destroys it. Only 6 percent of Americans believe the last stimulus created jobs, according to a New York Times/CBS News survey. Consumers are recovering from a debt-fueled bubble and have a moral aversion to more debt.

You can’t read models, but you do talk to entrepreneurs in Racine and Yakima. Higher deficits will make them more insecure and more risk-averse, not less. They’re afraid of a fiscal crisis. They’re afraid of future tax increases. They don’t believe government-stimulated growth is real and lasting. Maybe they are wrong to feel this way, but they do. And they are the ones who invest and hire, not the theorists.

The Demand Siders are brilliant, but they write as if changing fiscal policy were as easy as adjusting the knob on your stove. In fact, it’s very hard to get money out the door and impossible to do it quickly. It’s hard to find worthwhile programs to pour money into. Once programs exist, it’s nearly impossible to kill them. Spending now creates debt forever and ever.

Moreover, public spending seems to have odd knock-off effects. Professors Lauren Cohen, Joshua Coval and Christopher Malloy of Harvard surveyed 42 years of government spending increases in certain Congressional districts. They found that federal spending increases dampened corporate hiring and investment in those districts. You wish somebody could explain that one to you before you pass on more debt burdens to your grandchildren.

So you have your doubts, but you are practical. You want to do something. Too much debt could lead to national catastrophe. Too much austerity could lead to stagnation.

Well, there’s a few short-term things you can do. First, extend unemployment insurance; that’s a foolish place to begin budget-balancing. Second, you need to mitigate the pain caused by the state governments that are slashing spending. You need a program modeled on Race to the Top. You will provide federal money now to states that pass responsible long-term budget plans that will reduce spending and pension commitments. That would save public-sector jobs and ease contractionary pressures without throwing the country into a fiscal-debt spiral.

But the overall message is: Don’t be arrogant. This year, don’t engage in reckless new borrowing or reckless new cutting. Focus on the fundamentals. Cut programs that don’t enhance productivity. Spend more on those that do.

You don’t have the ability to play the economy like a fiddle. You do have the ability to lay some foundations for long-term growth and stability.

Your Comments

0 Responses. Comments closed for this entry.